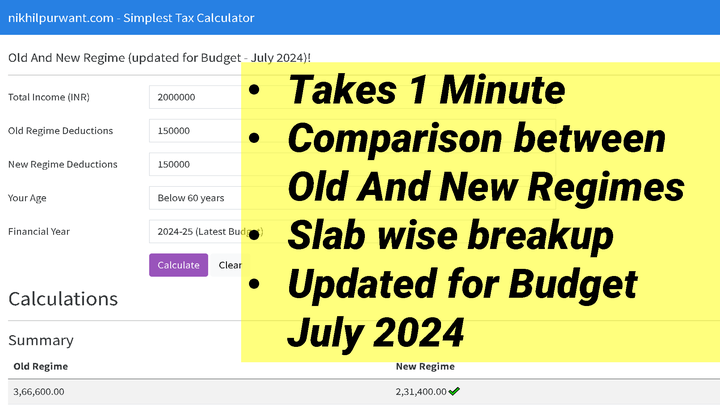

10. Old vs New Tax Regime (Updated for Budget July 2024) - Simplest Calculator For Your India Taxes 💰📆🧮🔎

🎯 Link for the simplest calculator - 👉👉 calculate taxes.

Note - This is not a comprehensive calculator for all possible tax situations. But it provides a good general guideline as to which regime is best for an individual in the fastest way possible with least number of inputs!! Check instructions below. There’s a Video Demo as well.

After the budget presented in July 2024, there have not been any changes to the old tax regime but there have been some changes to the new tax regime.

The tax calculator is updated accordingly. Please choose the FY properly.

DEMO

Instructions

- Access the calculator by clicking 👉👉 here

- Enter Income in Total Income (INR) field

- Enter Deductions you generally claim in Old Regime field. Please do not consider the standard deduction. The tool will consider it based on various factors automatically.

- Enter Deductions you generally claim in New Regime field. Please do not consider the standard deduction. The tool will consider it based on various factors automatically.

- Select Age Bracket

- Select the financial year (e.g. 2024-25 for the July 2024 budget).

- Click Calculate

- You can clear with Clear button and calculate again.

💡 Please use Ctrl+C to copy and Ctrl + P to paste

Disclaimers

- Please input the deductions correctly. For new tax regime very few deductions are allowed, here is the list of allowed deductions.

- This calculator is for reference purpose only. It does NOT provide any financial advice or recommendation. It gives a good general guideline to compare tax regimes

- We do NOT store or share any data entered on this application.

Please share if you think it’s useful! And please comment if you find any issues with the calculations!

Thank you for reading through.

-Nikhil